EB-5 investors achieve immigration success during COVID-19October 30, 2020

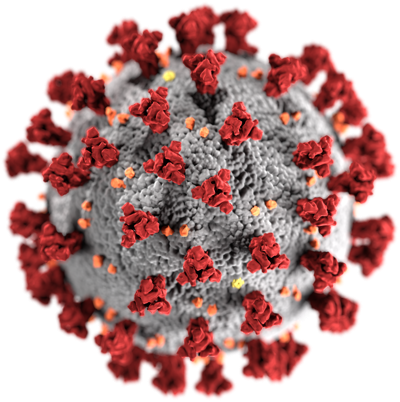

There is little debate that the COVID-19 pandemic has caused wide-spread negative impacts to the global economy and our way of life, including social interactions, employment, health care, and international and domestic travel. Society has had to adapt to the new landscape by wearing masks in public places, working and attending school remotely, making fewer trips out of the house, and ultimately doing less shopping at brick-and-mortar stores.

Likewise airlines, hotels, and tourist destinations have seen dramatic impacts to reservations and consumer spending. On the other side of the scale, logistics and fulfillment centers, supply chain distribution channels, and medical equipment manufacturing have seen a boom. The e-commerce industry and the companies that fund, build, and support that industry are seeing opportunity in the midst of the current COVID-19 environment. Many of these organizations are preparing for consumer buying habits to permanently change because of the pandemic.

As we have witnessed significant impacts to the global markets, the EB-5 regional center program and all of the EB-5 industry has not been immune to the impacts caused by COVID-19, although the effects on each type of investment have varied greatly. As previously mentioned, the hospitality, retail, and tourism industries have been greatly impacted.

Further amplifying the challenges to businesses, governmental mandates limiting in person seating and changes in consumer habits have left these traditionally flourishing businesses attempting to redefine their operations before it’s too late for recovery. Sadly, many restaurants and other small businesses whose foot traffic largely accounted for their revenue streams have made the choice to temporarily (or in some cases permanently) close their operations. Resulting in high unemployment for some sectors in the economy.

Contrary to the negative impacts COVID-19 has had on the hospitality industry and retail market, in which many companies still relied on the more traditional brick and mortar stores, COVID-19 has actually acted as a catalyst to spur significant growth in the e-commerce industry. As sharp as the increase in demand for e-commerce has been, it is also acting as the primary driver focusing on the importance of available current market inventory and the investment into logistics/distribution space.

CMB Regional Centers has historically offered EB-5 investment opportunities in a variety of industries. The diversification of EB-5 investment opportunities has been intentional to properly align with the goals and backgrounds of our diverse clients and their family members, as well as take advantage of market trends and provide an EB-5 investment that not only gives a high likelihood of success in immigration (obtaining a green card), but from a financial perspective as well.

In keeping with the goals of our clients, the first thing that makes CMB’s current offerings attractive for EB-5 investors is the likelihood of achieving their immigration pursuits to the United States. The EB-5 program requires the creation of 10 new American jobs through the EB-5 investment. In the current CMB offerings, all job creation requirements are projected to be met and exceeded through the construction of the target projects.

In short, full time jobs are created when the money is spent. In other higher risk projects, the job creation may be dependent upon the operation of the facility once completed. If that project or industry has a high likelihood of being impacted by COVID-19 or other market fluctuations, the likelihood of immigration success diminishes.

The success of their immigration pursuit is the most important goal for all EB-5 investors; after that the next priority is the security of the investment. CMB has decided to focus on a familiar and strategic industry for its current offerings: EB-5 investments to fund logistics facilities for Fortune 500 internet retailers.

While many industries have been impacted by the pandemic, logistics and online retail are projected to continue to see significant growth due to the adaptation in how society shops for the foreseeable future.

In addition to focusing on an industry that is experiencing growth while the economy as a whole has contracted, CMB is continuing to work with a trusted and proven award-winning developer, Hillwood Development Company, with years of experience in the construction of logistics and warehousing facilities throughout the United States.

CMB, as a leader in EB-5, and particularly when working with Hillwood, has achieved a level of success for EB-5 investors that can be measured by the track record of past CMB EB-5 partnerships that had with Hillwood as the borrower.

There have been 31 past CMB partnerships that loaned EB-5 funds to Hillwood with great success. CMB has already had 14 of the 31 Hillwood projects achieve loan repayment and come full circle. This means our EB-5 investors who funded these projects have achieved permanent residency in the United States (through an I-829 approval) and received a return of capital.

CMB Regional Centers is one of the most experienced and successful regional centers in the EB-5 industry, and has had successful projects in a variety of industries. We continue to look at new and innovative ways to produce the highest likelihood of immigration success and financial security for our investors. The current capital investment amounts for foreign investors are USD $900,00 or $1.8 million.

Given the current health and economic crisis throughout the world, we recognize the importance of finding the right project for our clients in today’s environment. CMB EB-5 Regional Centers believes that its current offerings truly meet and exceed all EB-5 requirements, and provides a level of financial security that other currently available EB-5 offerings may not be able to offer.

If you would like to learn more about the EB-5 Visa, or CMB’s current EB-5 offerings, please contact us here to schedule a free initial consultation with a CMB Investor Relations Manager. We are here to help with the entire application process.

CMB Regional Centers engages Prevail Capital, LLC, a broker-dealer registered with the SEC and a member of FINRA and SIPC, to be the administrative placement agent for all CMB EB-5 partnerships.