Gold Card Immigration Program Officially Launched

The latest America-first initiative from the Trump Administration promises to expand legal pathways to permanent residency in the United States

On September 19, President Trump signed an executive order (EO) formally establishing the “Gold Card” program, a new gift-based path to permanent residency in the United States.

We feel it is important to clarify the details of what this program entails, which differ significantly from earlier announcements, and how it compares to the long-standing EB-5 Immigrant Investor Program.

Gold Card 101: What is it?

According to the EO…

- Agencies charged with the rollout will constitute a $1 million gift as evidence of an extraordinary ability to qualify under EB-1 or EB-2, subject to final rules and adjudication.

- Corporations may sponsor an individual candidate for a $2 million gift.

- The singular $1 million or $2 million gifts are non-refundable.

- Capital contributions are paid directly to the Department of Commerce, with vetting handled by the Department of Homeland Security.

- Overall, the proposed program adopts a fee-for-residency model.

Gold Card: Fact or Fiction

| Claim / Gold Card Feature | Explicitly in the EO | Not in the EO (Ambiguous) |

| Derivative (spouse/children) coverage | The EO makes no mention of derivatives (spouse/children) | The EO does not guarantee that dependents will be included under the same $1 million gift and application as the primary applicant. |

| Expedited adjudication / “expedited processing” | The EO orders that application and adjudication be “expedited…to the extent consistent with law and public safety and national security” | The EO does not specify how fast “expedited” is nor what it entails, or how the current visa backlog in the EB-1/EB-2 visa categories will be resolved. The EO does not override per-country visa caps. Applicants from India or China may face significant wait times. |

| Implementation timeline | The EO gives 90 days to implement procedures: application, adjudication, visa issuance, adjustment of status, when to start accepting “gifts,” fees, etc. | The EO does not commit to a launch date for actual submissions/applications beyond saying agencies must designate the date for accepting gifts. It does not guarantee the program will be fully functional in 90 days or whether an application will encompass families or one individual. |

| Visa category | The EO does not create a new visa category. Instead, it integrates the gift concept into existing employment-based (EB) visa preference categories (EB-1 and EB-2) | The EO does not amend statutory caps, impact per-country limits, or override visa numerical ceilings. |

| Tax treatment / exemption for non-U.S. income | The EO does not include any tax exemptions or rules about taxation of non-U.S. income. | The promise (on tertiary websites) that a “Platinum Card” would allow up to 270 days in U.S. without U.S. tax on non-U.S. income is not in the EO. |

| Relationship to EB-5 | The EO specifies EB-1 and EB-2 as the visa categories aligned with the Gold card. The EO does include a clause wherein agencies could “consider expanding the Gold Card program to visa applicants under 8 U.S.C. 1153(b)(5) . |

The EO does not attempt to terminate or repeal EB-5* or state the Gold Card is a replacement.

|

How EB-5 Compares

The Gold Card may appeal to individual applicants willing to pay a non-refundable gift of $1 million, while EB-5 will likely remain the choice for those who prioritize a family-centric immigration path with the possibility of full repayment of capital.

- Gold Card: For a $1 million gift to the U.S. government, the prospective immigrant can apply for an experimental pathway toward an EB-1 / EB-2 Gold Card visa, pending resolution of the proposed rollout and barring any legal challenges of implementation.

- EB-5: For an $800,000 investment**, the prospective immigrant could invest in a job-creating project to qualify for an EB-5 immigrant investor permanent visa.

Both EB-5 and the EB-1/EB-2 Gold Card represent America-first pathways for global investors:

- Gold Card: Underpinned by financial contributions/gifts from prospective immigrants that are aligned to national interest.

- EB-5: Family-centric immigration with a focus on creating American jobs and investment in American communities.

Each serves a distinct and important need of the American people: creating jobs (EB-5) and reducing the national deficit (EB-1/EB-2 Gold Card).

For Additional Resources:

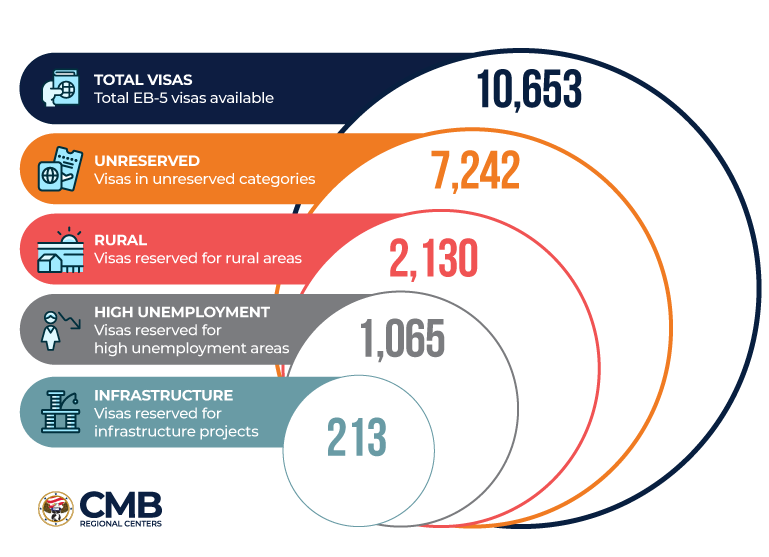

– Comprehensive Guide to the EB-5 Program

– A Data-Driven Look at the EB-5 Program

*EB-5 is fully reauthorized by Congress through September 30, 2027 under the EB-5 Reform and Integrity Act of 2022 (RIA).

**$800,000 investment amount applies to qualified investments in projects located in a Targeted-Employment Area.